Choosing the right Online Booking Tool (OBT) can feel overwhelming, especially with so many options out there. Whether you’re considering well-known platforms like Concur, GetThere, Cytric, or Deem, or eyeing newer players like Atriis, it’s important to find the one that fits your agency’s needs. Each tool has its own strengths, from content integration to flexibility and global reach. In this post, we’ll break down what makes these OBTs different and help you decide which one is the best match for your business.

Overview

- Key Players in the OBT Market

- Criteria for Evaluating OBT’s

- Evaluating Content of an OBT

- Evaluating Functionality of an OBT

- Evaluating Global Applicability of an OBT

- Conclusion

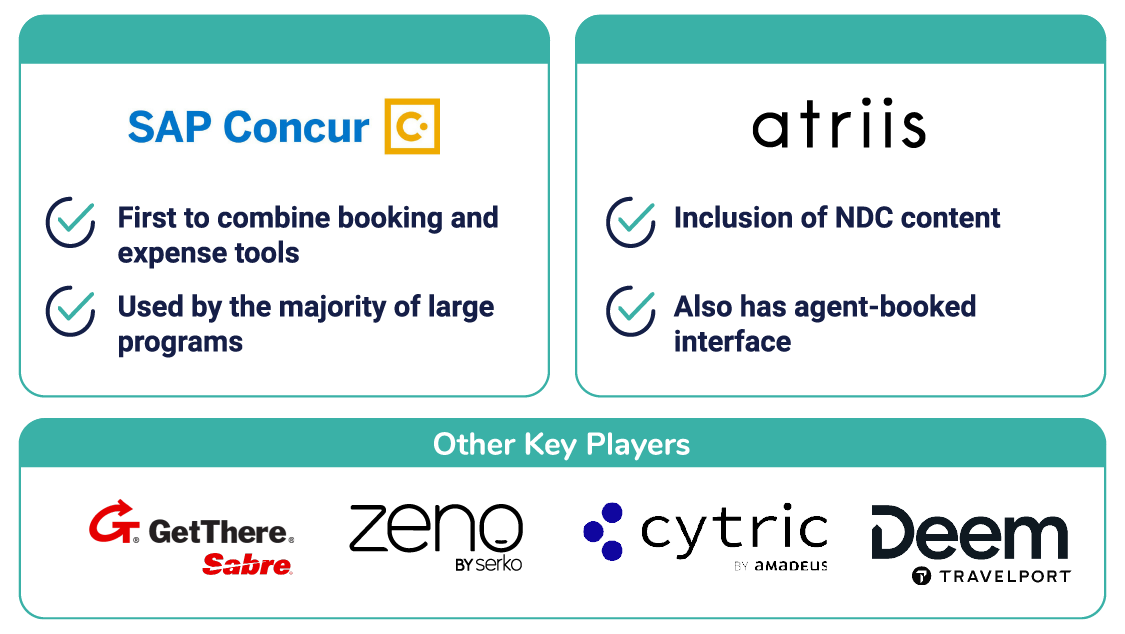

Key Players in the OBT Market

The landscape of the online booking tool (OBT) market is characterized by a handful of major players, accompanied by a rising wave of innovative entrants poised to challenge the established order.

Established Tools

SAP Concur dominates the market, known for

its integrated travel booking and expense management. Widely used for over 15 years, Concur is the most commonly used OBT for major travel programs globally. Other significant players include GetThere (owned by Sabre), Cytric (owned by Amadeus), Deem (recently acquired by Travelport) and Zeno (owned by Serko).

Disruptors

Atriis represents the new wave of OBTs, gaining traction in the late 2010s. Setting itself apart with a focus on New Distribution Capability (NDC) content, Atriis stands out as an innovative force challenging traditional norms.

Critera For Evaluating OBT's

- Content

- Functionality & Integrations

- Presence & Language

- Cost

Evaluating Content

The purpose of an OBT to is to book content, so it’s vital to properly evaluate what content is available in the systems under consideration. Beyond the presence of the content, consider the source of the content and the impact on functionality, serviceability and cost.

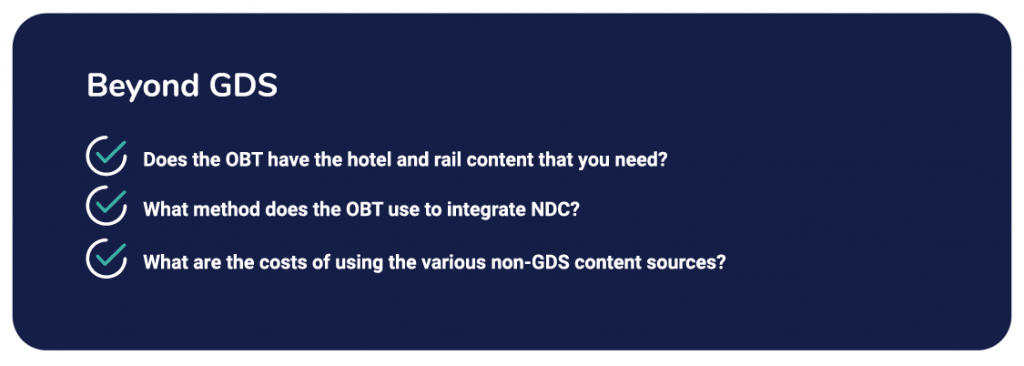

GDS Connectivity

All major OBTs pull content from GDS. Even those owned by GDS companies maintain the ability to connect to competitors’ GDS platforms. However, these three companies will generally prioritize development within their own systems first. Simple connectivity does not always mean full functionality. There may be limitations by GDS for features such as exchanges or split ticketing.

Non-GDS Content

Most OBTs bring in a variety of non-GDS content. This includes 3rd party hotel aggregators and direct supplier connections such as rail providers, certain car content and some airline direct content. With many of these content sources, additional transaction costs apply or certain functionality may be limited. For example, if the content source requires immediate payment or ticketing, it will typically not work with pre-trip approval functions.

NDC Content

OBTs bring in NDC content using one or more of the following methods: direct connection to the airline’s NDC system, NDC via the GDS or via a third party (mostly commonly TravelFusion). While direct airline connections would seem most efficient, you are relying on the OBT to connect to each airline from which you need content and they tend to prioritize only the most commonly used airlines. Also, you’ll typically need to setup a separate process for post-ticketing servicing. Travelfusion has many airline NDC connections but there will be an added cost and some functional limitations. NDC from the GDS is most efficient for servicing but OBTs have been slow to fully integrate that functionality.

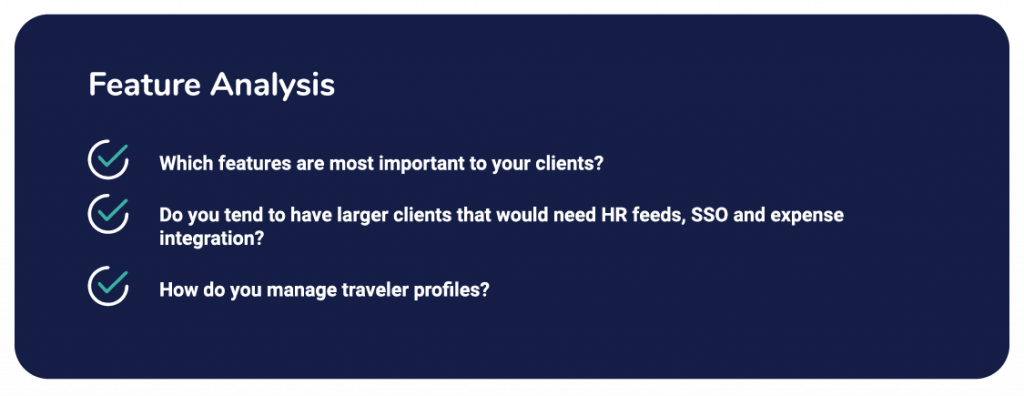

Evaluating functionality

Common Functions

There are a set of core functions that exist across all the traditional OBT systems and most of the new entrants. These include features like travel policy rules, approvals and guest bookings. Similarly, most systems can accept data feeds to automatically import users from a client’s HR system.

Expense Integrations

Integrations beyond HR feeds will show greater differences. Most notably, when considering integration to expense management systems, Concur Travel will only connect to Concur Expense while other OBTs have a much more flexible approach.

Profile Synchronization

Typically, OBTs will synch profile data from the OBT traveler profile into the GDS. Some systems will offer a 2-way synch though this is rarely used. For agencies that use a 3rd party profile management suite, some systems will offer this connectivity but this is far from universal.

Costs

Once you’ve established the capabilities, functions and integration options, be sure to look at the related costs. Aside from traditional transactional costs, many OBTs charge implementation fees for some of these integrations or features such as Pre-Trip Approval.

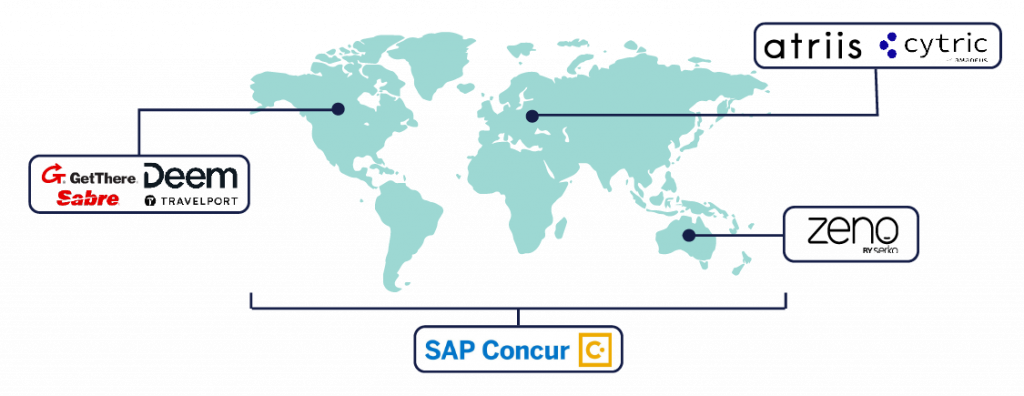

Evaluating Global Applicability

Almost all OBTs are global, in theory. However, real world usage considerations will narrow that list. In considering a best-in-market versus global approach to OBT, think not only of the client that is asking for the tool today, but also how you’ll offer this to other current and prospective clients.

Language & Content

Review the available end-user languages available in each platform. However, this can be misleading as we’ve seen platforms with dozens of languages that are still primarily relevant to one major market. More critically, look at the available non-GDS content. Considering the markets in which you’ll offer the tool, does it have key rail vendors and popular low-cost airlines?

Presence of Major Tools

Amongst the most common OBTs, Deem & GetThere are dominant in North America, while Cytric & Atriis have strength in Europe and Zeno is popular in Australia & New Zealand. Concur is legitimateLanguage ly global in scope, but there are several major markets where it is not well-used.

Conclusion

Selecting an OBT for your agency and clients’ needs is a significant project, especially when considering the costs involved. Not only are there implementation, transactional and often minimum usage fees, there is also a significant administrative overhead. Expertise in administering these tools occurs through regular usage and familiarity. This can be challenging for an agency that doesn’t have sufficient volume, or the backing of a network like Uniglobe Travel.